|

Ruble Ruined — I’m sure you and all your friends have been spouting your very own garbage theories about what’s to come next in the Russian invasion of Ukraine, but if you want to really sound smart, maybe take a look at the economics of it all. If that sounds like you, look no further — The Daily Peel presents: A Rundown on Russia & the Ruined Ruble.

For lack of a better word, the Russian economy is, well, f*cked. For years now, Russia’s government and elites of society have been attempting to essentially insulate themselves as much as possible from possible Western sanctions. Hate to break it to you, Putin, but it didn’t exactly go as planned, I’d imagine.

Starting with the most obvious, it’s pretty tough to avoid economic fallout when you’re fully sanctioned from using the world’s reserve currency, the U.S. dollar. Sure, they have the ruble, but very few outside of Russia have ever cared about it.

Now, with respect to the value of the USD, the ruble is at an all-time low. One Robux is worth more than one ruble… and that’s from a damn video game.

Russia’s central bank carries loads of foreign currency reserves, but in reality, these “holdings” are simply entries in a database from central bank to central bank that shows who owns what. When one central bank (Russia) holds a bunch of other currencies, those other central banks are simply allowing Russia to hold it.

With little more than the flip of a switch, any central bank that issues currency can “freeze” the holdings of that currency held elsewhere. So with practically 0 reserves in effect, Russia’s ability to participate in the global financial market is like Bill Ackman placing a trade and not going on CNBC to hype it up… it just doesn’t happen.

But, it doesn’t stop there. An exodus from Russian assets seems well underway, particularly with things like BP divesting its $14bn stake in a Russian oil company.

Additionally, if you need a good laugh, check out the stock price of the massive state-owned Russian oil company Gazprom ($OGZPY), which dipped 42.1% yesterday. This comes broadly as a result of many other funds following in BP’s footsteps.

The sovereign wealth fund of Norway, holding well over $1tn, has pleaded a divestment of Russian assets and stated they will not purchase any additional holdings. Sure, Gazprom is still pumping gas into Europe, but literally everyone hates it.

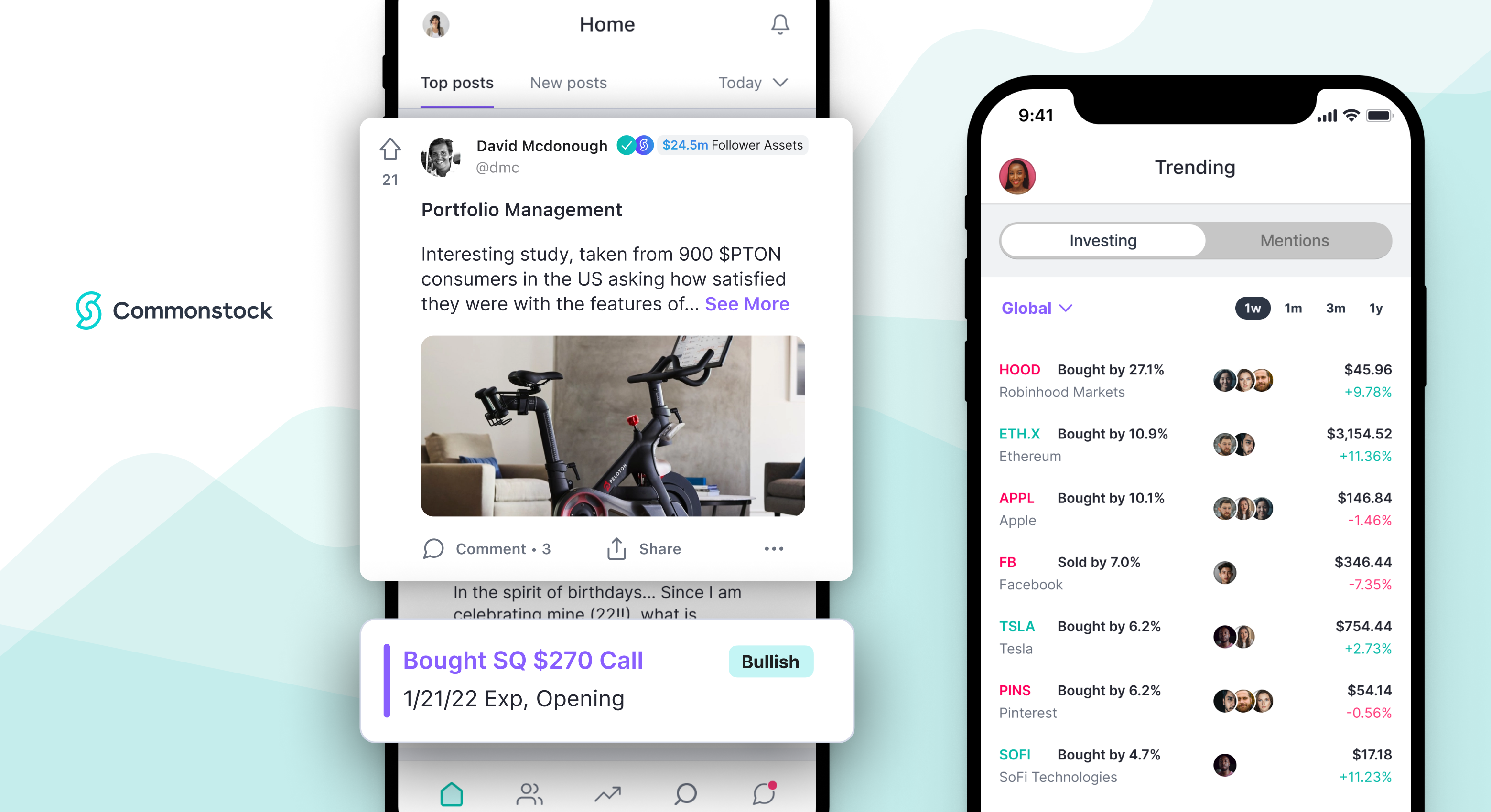

And that sucks. Even beyond yesterday’s share price collapse, Gazprom is the single largest taxpaying entity in the entire country, footing the bill of an estimated 6% of the nation’s overall tax budget. You can’t exactly survive with a stock price of $0. And while, of course, we investors never want to see our stocks hit $0, it does happen sometimes. That’s why you need to make sure the ideas you find are the best they can be, and what better way to do that than with Commonstock?

Lastly, some countries are getting creative with their sanctions as well. Several, including the U.K. and Canada, have banned Russian aircraft from flying in their airspace, while others are going as far as attempting to seize the most prized possession of every oligarch: their yachts.

So, even if traditional economic sanctions don’t work, maybe not being able to hop in their yachts will convince some oligarchs that Putin just is not that guy. One way or another, it’ll be interesting, to say the least.

|

Fugit nihil consequuntur cumque veniam harum quae. Aut eaque voluptatem ducimus qui ex. Cumque qui molestiae et necessitatibus voluptatem. Voluptatem ullam est porro reiciendis enim asperiores. Et quo rem inventore et autem omnis sunt. Facere rerum voluptas quo id tempora sit vel fuga. Expedita ut dolorem dicta molestiae hic quis harum.

In ex ea ipsum labore necessitatibus. Consequatur alias incidunt soluta est. Tempore saepe quia quia aut veritatis.

Ab quo dolor quia in omnis veritatis ex. Animi sed molestiae aliquid mollitia. Dolore dolor modi aperiam voluptatem veritatis quo blanditiis. Numquam ipsum quisquam atque praesentium in enim et. Commodi sit expedita maiores dignissimos.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...